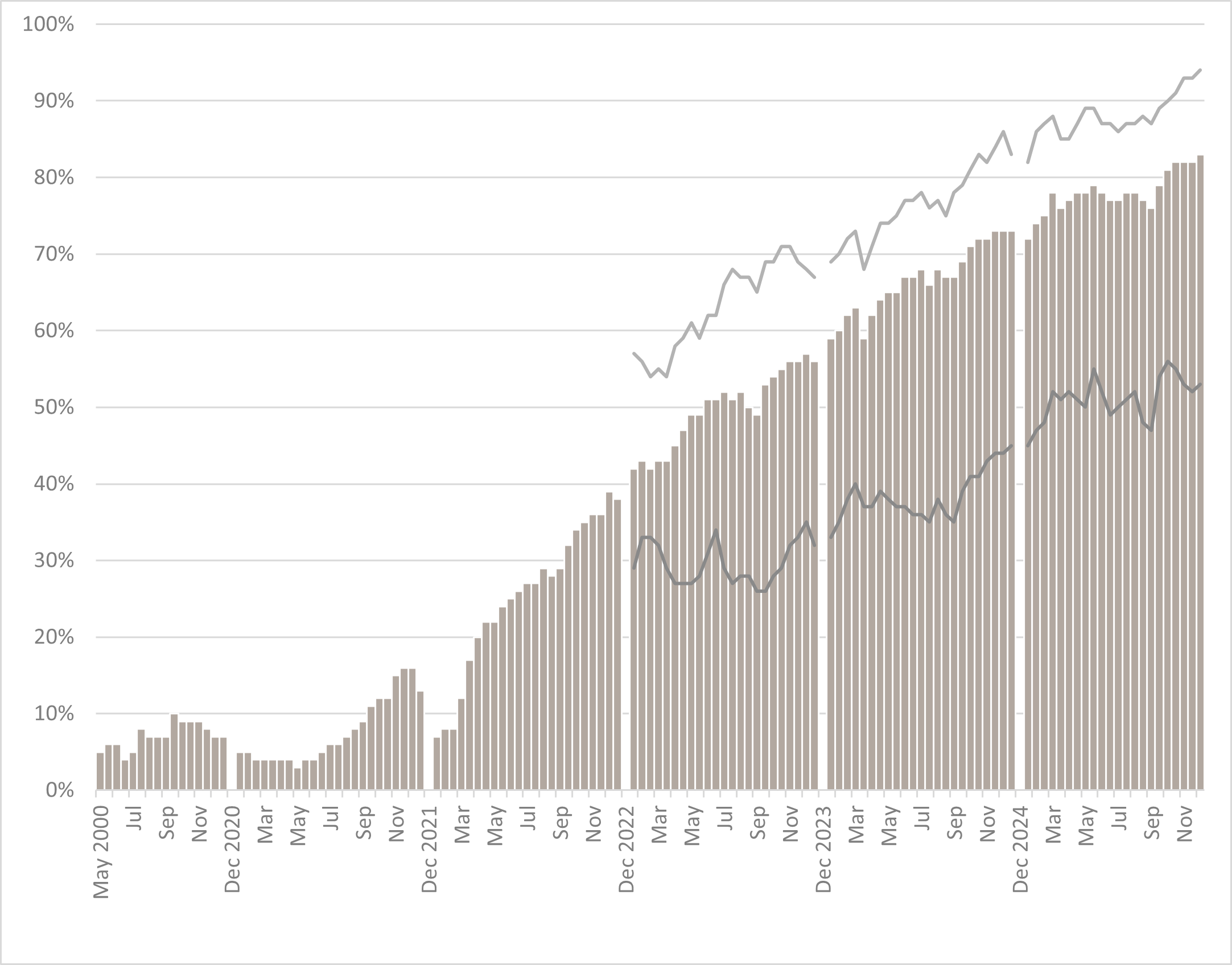

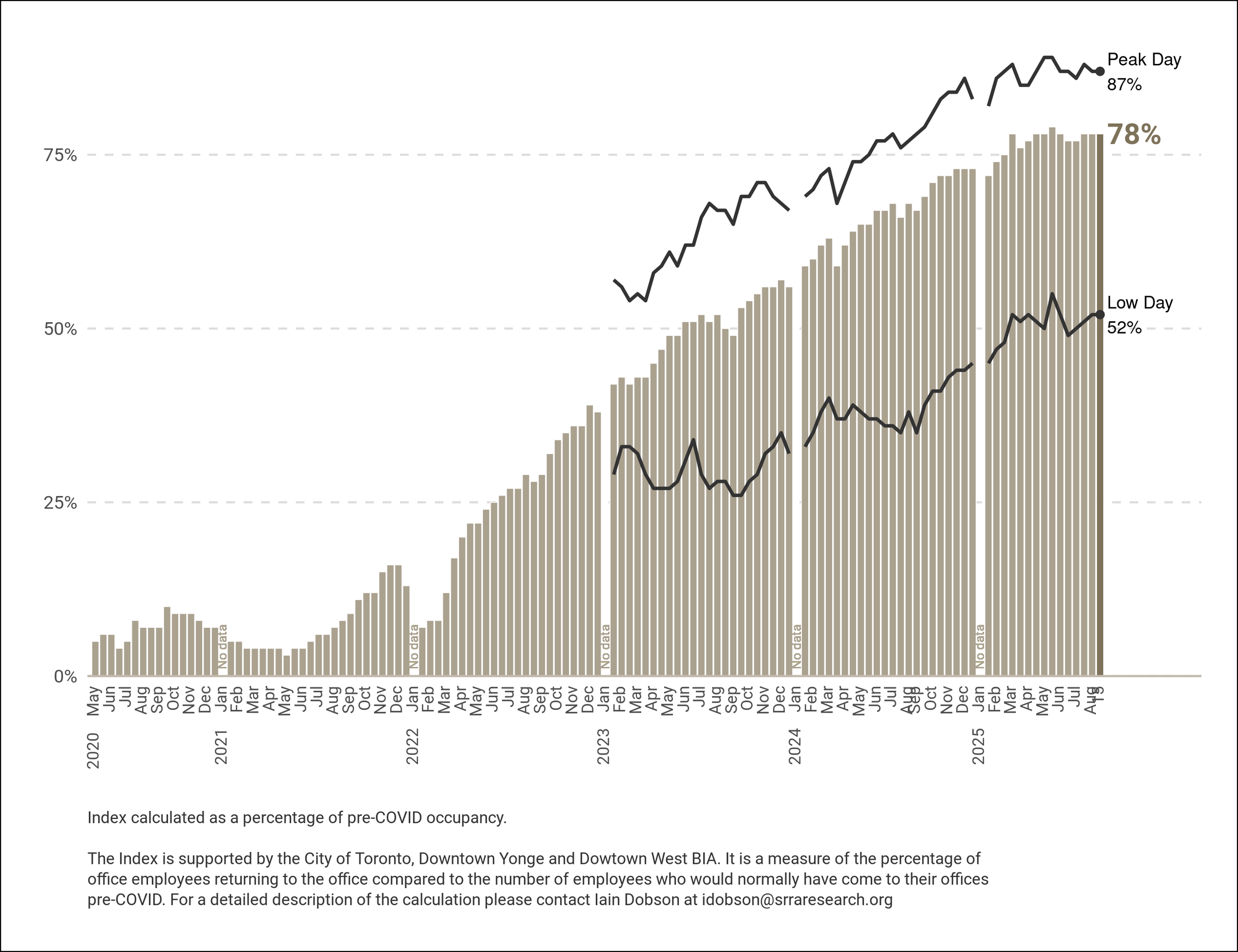

Average weekly - 83%

Peak Day - Wednesday 94%

Low Day - Friday 53%

The return to the office has not changed very much at the end of 2025. Unfulfilled mandates have been rescheduled for 2026, but if history tells us anything change will be gradual. After 5 years of meticulously preparing this measure of in-office work in downtown Toronto we can say with assurance that we still have not landed on a new normal. Several trends have emerged,

OFFICE SPACE The death of office space as predicted by many outside the commercial office investment business has not occurred. Supply is shrinking, rates are climbing and investors in “AAA” buildings are again considering building new sustainable projects to meet demand.

OFFICE PREMISES Tenants are reconfiguring space to allow for a portion of remote work while optimising the cost of office premises. How this will encourage or discourage in-office work is yet to be determined and is worth watching through 2026.

CONGESTION When employees choose to work remotely on Monday and Friday it makes for havoc on the streets and transit operators. Employers need to address this problem asap.

RETAIL trends before COVID are resurfacing while retailers continue to cope with the mid-week bubble in traffic. Emerging businesses which are occupying space at higher levels than the rest are providing some optimism.

Next Index – February 2nd, 2026. Have a productive and prosperous New Year

Enjoy the ‘Articles of Interest’ below.

Your SRRA team

Links to Articles of Interest

Frank Gehry Made an Indelible Impact on the World’s Skylines – And Soon in Toronto

After years of controversy, the first of two very tall towers designed by legendary architect Frank Gehry is under construction on King Street. Originally the brainchild of theatre mogul David Mirvish, the project is now owned by Great Gulf Corporation. Gehry died in early December, aged 96. The current version of the project preserves the Princess of Wales theatre and older heritage buildings. In addition to 2000+ luxury condos, the project will include a new campus for OCAD University and a public art gallery, which is fitting, given Gehry’s passion for art.

Read Article Here. and Read Article Here.

U.S. Real Estate Landscape Quickly Evolving as “SMART” Invest in Office Assets

Office space is back.

What Can Canada Learn from New York’s Example? ‘The City of Yes’ Stimulating Affordable Housing Boom

Many of us would respond with “Big Apple” if asked to quickly cite an example of the New York brand, but maybe a fresh approach to zoning taken called ‘The City of Yes’ could start to rival the place long occupied in our psyche by that image. One example of the shift in approach that one year in is credited with stimulating massive change in the approach and feasibility with respect to affordable housing can be summed up with this quote. “City of Yes created the Universal Affordability Preference program, which replaced the city’s Voluntary Inclusionary Housing program. The program provides a 20 percent density bonus to projects if the extra space is dedicated to permanently affordable housing, which must, on average, be affordable to those earning 60 percent of the area median income.”

An Object Lesson for Politicians Wishing to Make Informed Policy Choices?

This article offers a history-rich, objective analysis of conditions contributing to the physical and financial feasibility of converting older office buildings to apartment use in New York. The

Office Adaptive Reuse Task Force, chaired by the city’s chief planner, explores opportunities but also pitfalls in an environment where the cry ‘housing crisis’ can sometimes be used as a blunt instrument by policy makers. The task force’s emphasis on creating the conditions that actually deliver quality apartments – with sunlight, physical access and more – is an object lesson for officials in Ontario.

Tariffs Said to Be Cause of Project Failures in U.S.

New analysis is pointing the finger at tariffs as a principal cause for rising construction costs – the reason so many developers are abandoning projects – even those with a valuation of $1B.

Is Remote Work Dying? The Answers Will Surprise You

Finally, our links are usually to articles found in the business and mainstream media. This link is an exception – it takes you to a podcast prepared by a specialist consulting firm. The podcast provides a variety of nuanced, different perspectives and is well worth a listen.

“The Occupancy Index is supported by the City of Toronto, Downtown Yonge BIA, and Downtown West BIA. It is a measure of the percentage of office employees returning to the office compared to the number of employees who would normally have come to their offices pre-COVID. For a detailed description of the calculation please contact Iain Dobson at [email protected],”