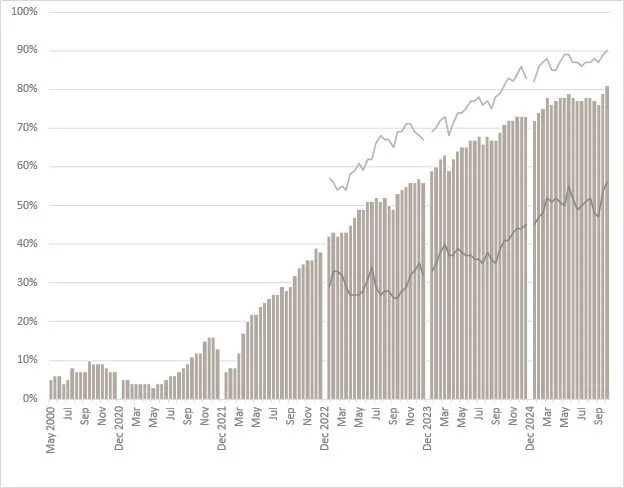

Average weekly - 81%

Peak Day - Wednesday 90%

Low Day - Friday 56%

Fridays and Mondays are becoming much busier in downtown Toronto driving the Occupancy Index up. It isn’t just the Blue Jays winning ways (GO JAYS) but it appears that the mandates driving more in office work is building attendance at the beginning of the week and at the end. This trend is likely a result of mid week congestion on the roads and unacceptable commute times on transit.

We are also hearing stories and getting some data on companies struggling to provide desk space for returning workers. The outcome of this trend will suit commercial property owners and is leading to lower vacancy rates in almost all classes of office space.

Data for early October sees both of these trends continuing.

Enjoy the ‘Articles of Interest’ below.

Your SRRA Team,

Links to Articles of Interest

Pandemic-Era Decision to Move Away in Search of Cheaper Housing Creates Dilemma for Many as Employers Cancel Remote Work Rules

During the pandemic, the sudden opportunity to work remotely saw many office workers looking for less expensive housing relocate further away from their downtown jobs (and also to find better places to accommodate the needs of two family members working from home).Now, with employers moving quickly to require a physical presence in the office once again, the pendulum is swinging back, leaving those who left with a costly dilemma. Caught on the wrong side of a dramatic change in housing prices, some office workers are looking at taking a financial hit to move back to be in closer proximity to their jobs or face impossibly long commutes.

Wild Swings in Average Housing Prices Across Canada Feeding on Uncertainty

Vancouver and Toronto have long been Canada’s least affordable housing markets, but even after significant fluctuations that began during COVID led to lower average prices in those cities, the reality is that housing remains unaffordable for a majority. At the same time, cities such as Calgary, Saskatoon and Moncton, once seen as providing hope for those looking to buy, have seen their average prices climb into unaffordable territory. While the charts displayed in this article are informative, we still await research that makes a direct link between housing costs, job potential, and underlying trends such as remote work.

City of Vancouver to Require Five Days in the Office Starting January

Citing a need to “keep pace” with employer trends across the country showing the demise of hybrid work conditions for office workers, Vancouver’s city manager recently announced that most of the city’s office staff will be required to be in the office five days a week as of January 1, 2026. Union leaders have criticized the move, claiming that there will be “negative impacts on employee health, autonomy, and work-life balance.” Where is the evidence that being in the office full time leads to greater productivity they ask?

Insights from Respected Planner Show “Housing Crisis” Nothing New

The term “housing crisis” has been on everyone’s lips for a while now, but what does this have to do with economic opportunity and the future of work? A new book about the St. Lawrence neighbourhood co-authored by a planner “who had a hand” in creating the place reminds us that there was a declared “housing crisis” some 50 years ago in 1974 when federal, provincial, municipal, non-profit and private sector brains were effectively harnessed to create a brave new world of city-building. How was it possible to create an affordable neighbourhood only a few steps from Bay Street, Canada’s most expensive real estate? Part of the answer is “political will” – evidenced through the role played by reform mayor David Crombie. This article suggests how that link between housing affordability and economic opportunity can be usefully addressed.

Layoffs in Canada’s Banking Community Signal Increasing Complexity Facing C-Suite Whether it is growing uncertainty about the economy, coping with the rise of AI, recent announcements by TD Bank reveal that even our banks are not immune to the whip-saw impacts of global trends. Commenting on a decision to “stagger” return-to-the-office plans while laying off up to two per cent of staff, TD insists that the bank “continues to invest in talent and the capabilities that we need for the future, including substantial investments in front line advice, digital, and AI and data-driven solutions.”

“The Occupancy Index is supported by the City of Toronto, Downtown Yonge BIA, and Downtown West BIA. It is a measure of the percentage of office employees returning to the office compared to the number of employees who would normally have come to their offices pre-COVID. For a detailed description of the calculation please contact Iain Dobson at [email protected],”