Policy choices made by the federal and provincial governments, the U.S. and internationally will have a significant effect on medium-term economic impacts. As presently configured, government programs are sufficient to support basic consumption by individuals and provide relief for recurring expenses for a range of businesses.

These programs will provide a floor to demand and will help avoid the erosion of demand over the short-term from now through to Spring, 2021. More concerning, however, is that these supports will not be sufficient to sustain demand over the medium or even the longer term. Unlike previous recessions, the COVID recession is the result of ‘demand suppression,’ or, for some industries, ‘demand elimination.’

Particular Risk to Small Business and Non-Government Organizations

The immediate and medium-term risk is greatest to small businesses. The Canadian Federation of Independent Businesses (CFIB) reported in November 2020 that 51% of respondents to their survey noted permanent closure within 1 year was likely based on current demand and revenue drops. More than half -- 56% -- said that surviving the second wave will be a challenge.

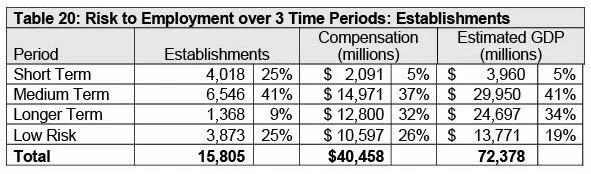

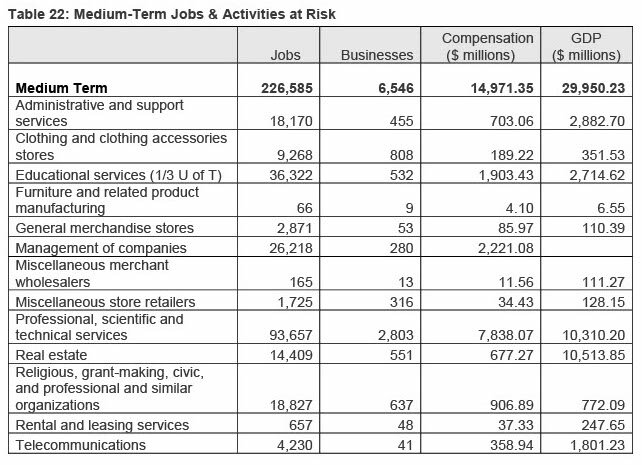

The longer this demand reduction persist, the greater the risk. SRRA estimates more than 225,000 jobs, in addition to the nearly 81,000 now in peril, may face significant challenges over the medium term. It is this medium-term risk that is the most challenging representing almost $30 billion in GDP and more than 40% of all downtown employment.

Thirty percent of NGOs have had to lay off staff, totaling about 3,000 jobs. Some 20% report that, without specific financial supports, they will close permanently within six months.

In Toronto nearly 50% of NGOs indicate that will only be able to remain operational for one year under current conditions.

Economic Pressure on Residential Population: Younger workers in downtown, those in the ‘gig’ economy and students

There are 50,288 downtown residents who hold jobs in economic activities that can be considered to be at high risk to being impacted by COVID-related restrictions. This accounts for almost 28% of the employed downtown labour force. This does not account t for those engaged in the informal or “gig” economy.

Prior to the pandemic the Bank of Canada concluded that including this sector would increase labour force participation rates by 2-3%. In downtown Toronto this would mean 5,000 to 7,500 people but probably higher given the fact that younger workers are over-represented in the gig economy and are a larger share of the downtown population.

Some with these economically at-risk jobs, especially those with part time jobs, will also be students. SRRA estimates this number to be approximately 30,000 or 20% of all downtown households. How these people will act in a world of on-line schooling without the need to be located near classes and the elimination or severe reduction of the attractions and amenities of downtown is unknown.

These three parts of the downtown population total between 50,000 and 90,000. Allowing for overlaps among the groups it is concluded that as many as 70,000 downtown residents face economic pressures that may lead to their relocation over the medium term.

Raison d’etre for many to live downtown linked to a lifestyle snuffed out by COVID is leading to softening of condo-based rental market

COVID-driven changes to the downtown population are not just economic in nature. Many residents will have jobs in downtown jobs that are relatively insulated from COVID-related changes. For an unknown number of these residents the “choice” to leave downtown will be related not just to affordability concerns but also to perceptions of the desirability and attractiveness of downtown. Just under two-thirds of the nearly 155,000 households downtown live in rental units. At least annually, residents have the opportunity to relocate.

When assessing the risk that residents may choose to leave downtown it is important to note that Toronto’s downtown residents have a demographic profile that differs significantly from that of the rest of the city. As shown by demographic statistics, the downtown is in many respects very different from the rest of Toronto.

Downtown residents are younger, with 42% between the ages of 20 and 34

43% of households are headed by someone under 35

65% of downtown households are either single (i.e. not married) or are living with room

mates

63% have changed homes in a five-year period.

Taken together, these demographic realities show that the downtown population is more susceptible to change than the rest of the City. SRRA estimates this number to be approximately 30,000 downtown households.

Combined with residents facing economic pressures it is concluded that as many as 100,000 households may be at risk in the medium term. Mobility may be the underlying issue to most closely follow. TREB reports increased availability and average rents are also falling. The impact that the addition of over 45,000 condo units over the next 18 months may have on the supply and demand market for rentals is an issue to track as an indicator of the downtown’s return.

Downtown Toronto’s attractiveness as a destination for business travel, domestic and international tourism could be at long-term risk if current conditions persist

The attractiveness of the downtown is significantly related to the amenities and activities that are available. The very activities that have made downtown destinations attractive, however, are now profoundly undermined by the restrictions required by COVID. Cultural activities, hospitality and the tourism sectors are important attributes of the fabric of downtown. This vibrancy also feeds into the attractiveness and desirability to base corporate HQs in the area covered by the Financial District BIA.

An additional risk to the reputational attractiveness of the downtown is the increasing focus on pre-existing social inequities that have become more obvious and pronounced during the COVID pandemic. Some areas of downtown are reporting increases in petty crime and calls to 911. BIA managers have expressed concerns for the City’s reputation as a safe, clean place to shop, live and visit. Greater indicators of inequality and an emergent erosion of social cohesion are seen by many as people experiencing homelessness and those in precarious economic situations are more prominent.

Many observers suggest these inequities have increased and anecdotal evidence of increased substance abuse and vagrancy has added a new challenge for residents, the BIAs and their member businesses. In many respects what has always been present is now more visible as the masses of people – workers, students and tourists – who once dominated city streets day and night are now no longer present. In their absence, the most marginalized remain. Reports of greater reluctance to go downtown at night is an immediate early indicator of long-term reputational risk to the downtown.

All of these social variables add to the economic considerations faced by current and prospective residents of downtown neighbourhoods. As downtown confronts COVID it is clear that the centripetal forces that have been foundational to the area’s growth and attractiveness are profoundly compromised, while the centrifugal forces are both more apparent and growing. This combination creates a near perfect storm that challenges profoundly the short and medium-term viability of many downtown residential areas.

Manageable Risks to Government Revenues

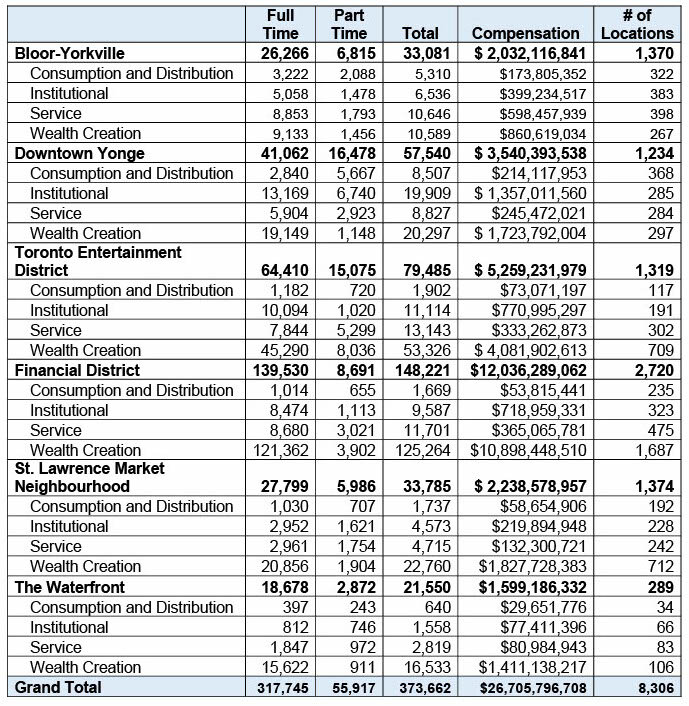

The City’s 2021 Operating Budget assumes an operating risk of $1.5 billion which includes decreased revenues and increased costs. In 2013 the Downtown accounted for 25% of the property tax assessment and this share has undoubtedly grown as downtown growth has exceeded the rest of the City.

Commercial and retail property in downtown is predominantly owned directly or through subsidiaries by large institutional investors primarily in the form of large pension funds. With stable portfolios and very long investment horizons these are in many respects the ideal owners for commercial real estate during a pandemic.

The City’s revenue base is not as exposed to economic downturn as the tax base shared by the federal and provincial governments which will see declining sales tax and income tax revenues that are not subject to City taxation. The biggest revenue challenge confronting the City is transit fares which should prudently be assumed to experience a 50% reduction -- $600 million – annual challenge through the medium term.

Assuming a $7.8 billion GDP reduction the assumed annual Provincial revenue loss would be approximately $1.1 billion in foregone tax revenues from all source and the Federal

loss would be approximately $1.6 billion in foregone tax revenues from all sources. This risk would increase over the medium term.

Loss of TTC revenue of more than half a billion dollars is City’s principal COVID-related fiscal challenge

The massive scale of revenue shortfalls experienced by the TTC will have a detrimental impact on the City of Toronto’s budget priorities for 2021, and the agency will be challenged to maintain current levels of service as a result of $660M shortfall in 2020.

Within Toronto, the subway (and to a lesser extent the surface streetcar routes) has traditionally been the main transit delivery source for downtown. Prior to the onset of the second wave of infections, total TTC ridership had returned to 35% to 40% of its pre-COVID levels. This, however, was largely been focused on surface bus routes. Subway usage remains historically depressed, a trend that will no doubt be exacerbated by restrictions on access to non-essential businesses imposed as a result of the second wave of infections.

A key contributor to the success of downtown is its walkability and access to multiple amenities made possible by a compact, dense urban fabric. This only works because transit is able to deliver the bulk of daily visitors. The return of office workers to the core is tied to re-establishing consumer and commuter confidence.

Transit in the Toronto area relies upon the fare box to an extent that far exceeds norms in other jurisdictions. The collapse in transit ridership has caused municipal transit operating budgets to crater. Prior to the pandemic, almost 117,000 commuters from the regions around Toronto used transit, mostly GO, to access Toronto, with many of these going to downtown destinations near the Union Station terminus of the GO rail service. This ridership has not yet returned. Metrolinx reports that ridership for April through September was down by 92.4%.

Restoring consumer confidence is key to resurgence of downtown

Impacts on those activities that support the larger economy (administrative, management and professional services) can be expected to assume new configurations. If the period of remote working extends for a sustained period of time it is inevitable that some changes made on a temporary basis may become permanent. Clustered in “white collar” activities, it is unlikely that job losses will be permanent but it is likely that the relocation of a portion of these away from the downtown will occur.

During the sustained lockdown in the spring of 2020, government programs provided unemployed and under-employed Canadians with sufficient support for basic consumption but were not enough to allow for discretionary spending. In addition, as restrictions were scaled back the combination of actual and perceived health risks encouraged many to avoid in-person shopping wherever possible, underscoring the importance of psychological and perceptual considerations as critical drivers of consumer confidence. Regardless of formal restrictions, these personal decisions will continue to play a determinative role for many consumers, especially when access to retail requires the use of transit which is still viewed with suspicion by many.

The persistence of physical distancing measures and border closures will continue to limit growth in the food and accommodation and entertainment industries.

Toronto’s Diversified Post-Industrial Economy is Resilient

Although an economic analysis addresses each strand of the economy separately, the reality is that downtown represents an entire cultural and socio-economic ecosystem. Calculating Toronto’s attractiveness as a destination for business travel, domestic and international tourism cannot realistically be done without viewing the amenities of downtown holistically.

With its unique blend of large-scale wealth-creating office-based and institutional employment, a growing residential population and its extensive range of cultural, entertainment and institutional assets, Downtown Toronto’s many attributes that made it prosper before COVID also mean it is well-placed to recover from the pandemic. The fundamentals remain intact but key sectors are vulnerable.

Long after COVID becomes a well managed public health matter, Toronto’s downtown will continue to be diverse, attractive to newcomers and provide the kind of concentration of opportunities in finance, health, post-secondary education, technology and culture that helped establish the City’s reputation for an enviable quality of life.

This report has outlined and sought to quantify the economic costs for the downtown created by the COVID pandemic. As detailed herein these costs are significant and the risks are especially shouldered by the lowest paid employees and small businesses. At a human level there has been and will be real pain for far too many.

It is equally true that the downtown economy’s structure and diversified nature mean it is very well situated to not only survive but thrive. It is important to note that the challenges faced in Toronto are the same as those faced by our international competitors. Managing recovery will see changes at the individual level but the long-term prospects for Toronto retail, tourism and other sectors challenged in the short term remains strong.

All of the factors that made downtown Toronto a desirable place to live and work prior to COVID will continue to be present as we manage COVID related challenges and long after COVID is either eliminated or managed as an endemic challenge within acceptable Public Health parameters.

Sponsors of this Study